Ready to learn more about launching a car title loan business?

"The Loan that Puts the 'Fun' Back in Funds"

Car title loans are a fantastic financial solution for individuals needing quick cash.

They offer a fast and convenient way to obtain money without the hassle of traditional loans or credit checks.

In this blog post, we’ll explore the many benefits of Car title loans and why they’re a great option for those facing financial emergencies.

Fast and Convenient Car title loans are one of the quickest and easiest forms of lending available. You simply bring in your car, and the auto title lender will evaluate its worth. If you agree on the loan amount, you receive the cash right then and there. The process is simple, straightforward, and hassle-free.

No Credit Checks. Car title shop loans don’t require a credit check, making them an excellent option for individuals with bad credit or no credit history. You won’t have to worry about your credit score affecting your ability to get a loan.

Flexible Repayment Options. Car title loan shops are designed to be flexible and accommodating, giving you the peace of mind you need during tough financial times. The repayment period is usually between 30-60 days, with the option to renew the loan if necessary.

Low-Interest Rates. Car title loans have significantly lower interest rates compared to payday loans or cash advances. This makes them a more affordable option for those needing quick cash.

Confidential and Discreet. Car title loans are confidential and discreet, which is essential for those who are private about their financial situation. You can obtain a loan without having to share your personal information with anyone other than your lender.

In conclusion, Car title loans are a fantastic financial solution for those needing quick cash. They offer fast, convenient, and low-interest loans without the hassle of credit checks or lengthy applications.

So next time you’re facing a financial emergency, consider the benefits of a Car title loan and get the cash you need to get back on your feet.

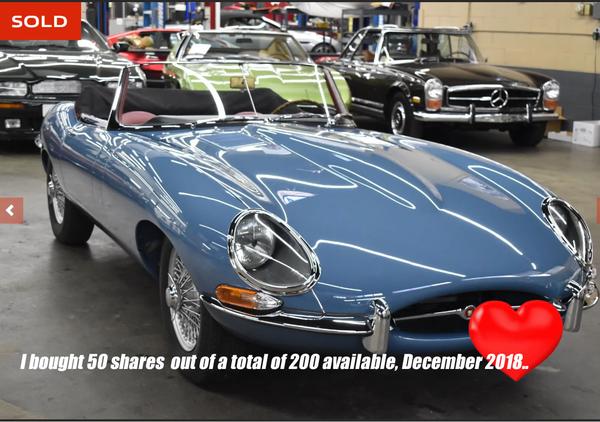

Title loans from the customer's perspective

Revving up for something new?

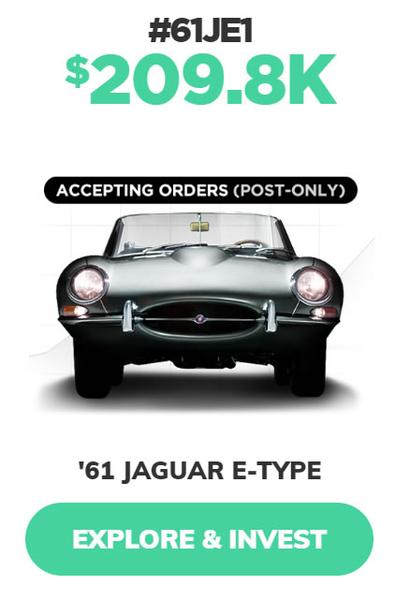

I’m thrilled to announce the expansion of title loan businesses across the country.

Auto title loan businesses.

This innovative approach to personal finance offers a unique advantage for those in need of fast cash.

Use your car as collateral and get the money you need in a snap.

No credit checks, no hassle.

Drive off with financial stability and peace of mind.

So if you’re ready to trade in financial stress for a revved-up financial future, let’s get started!