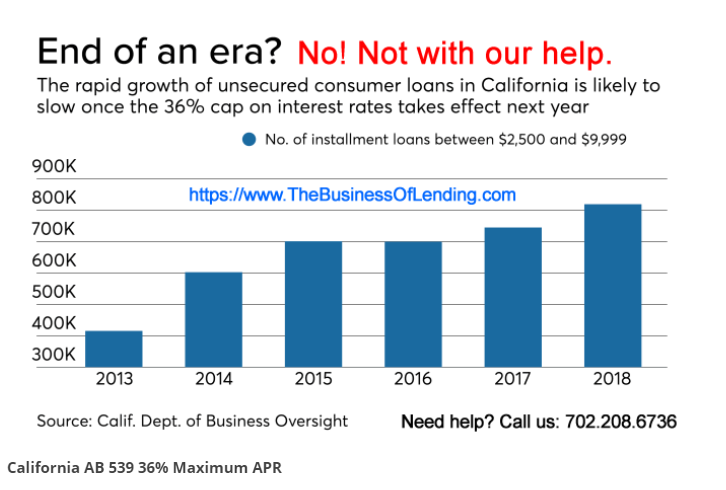

AB539-California 36% APR Rate Cap: Devastation + Disruption = Opportunity for CFL Lenders

By: Jer Ayles. Are you a California Lender operating per the CFL licensing model? Ready to throw in the towel, sell off your portfolio, collaborate with a federally recognized Native American Indian tribe, layoff your employees, tell the average Joe’s and Jills you simply can no longer serve them when they face a sudden financial emergency… Are you going to give up the business of lending money to the masses?

WHAT: California AB539 bans loans between $2500 and $10,000 with APR’s exceeding 36%. It became effective January 1st, 2020. This is huge. But, there are two fixes for this IF you choose to start or continue to loan money to the nearly 50% of Californians unable to access $400 cash in an emergency!

WHY: A $100 loan for 12 months yields the Lender $36.00 PER YEAR! Lenders cannot pay to acquire customers, pay their rent, pay their employees, process loan applications, spend capital on radio, TV, direct marketing, Google, Facebook, Instagram… process the loan applications [production costs] they secure via all these efforts… And then attempt to collect their hard-earned money by reaching out to customers by phone, text, letters…

RESULT: California loans of less than $4,000 = $5,000+ WILL NO LONGER BE OFFERED to consumers with “shitty credit.”

That’s life!

Consumers with poor credit, thin files, maxed credit cards, friends and families in the same boat, communities of color, low wage earners, Latino owned businesses, even the President of the NAACP said his constituents… “cannot qualify for a short term small-dollar loan ANYWHERE in California!” [Except perhaps from an illegal, unlicensed loan shark, by pawning the stuff in your garage, knock you over the head while you dodge the needles and excrement in the streets of your city, outrun the tent cites along your bicycle trails…

BANKS and CREDIT UNIONS [CU’s do are non-profits and do not pay taxes by the way] DO NOT WANT TO SERVE THESE BORROWERS! “It’s expensive, a hassle, and they do not pay back their loans in a timely fashion,” said a banker at Lend360!

Where are these ordinary Americans supposed to get their hands on $400 FAST to keep on the lights, pay for their kid’s prescription, fix the car so they can participate in the gig economy, or serve you your Big Mac?

READ ON! This may be a long read BUT it will save your business, your investment, your employees, your customers, your landlord, and your life’s work and contribute to the tax base enabling our elected officials to continue to abuse all Americans!!

Are you aware that the “big boys” sponsored AB539? They spent huge sums of $$$ on PACs and politicians in California to make certain all of us “little guys” cannot compete? Do you know that this 36% APR cap calculation does not include ancillary fees such as non-refundable loan origination fees, credit insurance [that only subsidizes the Lender and consumers must pay again each time their loan is renewed], club memberships, life insurance, accident, health, and disability insurance, involuntary unemployment insurance, property insurance, “nonfiling” fees, accidental death & dismemberment insurance, automobile security plans… MY Point? THE ALL IN APR – annual percentage rate – our sub-prime borrowers pay is HIGHER than the stated APR on their loan contract.

Guess who just a few of these “Big Boys” are:

- Lendmark Financial Services

- OneMain Financial

- Oportun

- Why? They implement a “loan packing” strategy. They add on all the “ancillary” products I mention here; none of which benefit the borrower!

Example? “Credit insurance premiums” are paid ALL UPFRONT! Credit insurance increases the cost of consumer borrowing by 33% while providing ZIP benefits for consumers. And again, these fees are NOT included in APR calculations!

THE REAL WORLD: A stated APR for a nine-month loan, $511 is 43% but the “ALL-IN APR” is 138%! Why? How? Because the so-called “big boy” PAC & politician enabled installment lender charges “credit insurance” with this loan and finances the lump-sum premium payment – $203. Thus, the amount financed increases from $511 to $714 and results in a 138% APR!

Do you know 10M+ US residents take out loans ranging from $100 – $10,000 and pay more than $10 Billion dollars in fees?

Do you know that banks and credit unions make the majority of their profits on NSF fees? They hate small-dollar lenders; unless of course they can provide $300M credit lines to the very lenders who sponsored AB539!

It’s CRIMINAL!

Smaller loans <$2500 MUST HAVE higher APR’s The operating costs for a Lender serving the sub-prime are simply TOO high. The fixed costs for a $500 loan are the same as for a $2500 loan! Upfront and customer acquisition costs are a much smaller share of the revenue from a $2500 loan vs a $500 loan.

California AB539: 36% APR Rate Cap = Devastation = Disruption = Opportunity

By now, the thousands of you who follow my rantings know that the Calif. Department of Business Oversight has begun enforcing the 36% APR rate cap [AB-539] on consumer loans between $2500 > $10,000. This bill impacts both title loans and personal, noncollateralized loans.

What’s this mean? 70% – 80%+ of the Lenders serving California consumers today will STOP funding these loans. 20 million consumers facing temporary financial hardships will have nowhere to turn to for a no-hassle, small-dollar loan FAST! 70% to 80%+ of California Lenders are shutting their doors, laying off their employees, shunning their landlord, not paying taxes… and wishing their thin-file, no file gig economy customers “SO LONG!”

DEVASTATION

Jorge Jones has a landscaping job in Los Angeles. His wife Francis works at a restaurant. Auntie, who lives 14 miles [a rent-controlled one-bedroom apt.] and 4 bus routes away, takes care of the Jones’ two kids.

Jorge’s 12-year-old Toyota pickup needs engine work. The bank turned Jorge down for a loan. Jorge’s credit card is maxed. He’s already borrowed from friends and family in the past; owes them money.

Mary, single with a 3-year old daughter, works for 2nd Chance Community Loans, a chain of 15 small-dollar loan stores in So. Calif. She knows the 1st names of all her customers, their kids’ names, their family situation… Her customers borrow money a few times per year when the washing machine breaks down, the oven takes a dive, the family car needs work…

They all live paycheck to paycheck; virtually no savings in spite of having tried. Life happens…

Carlos owns 3 strip malls. One each in Garden Grove, Santa Ana & Costa Mesa. He’s 55 years old. Worked his ass off as a carpenter, saved money, read real estate books, invested with a buddy in a run-down strip mall, refurbished it and eventually added two more. Each strip mall has the usual mix of Circle-K, a couple of restaurants, dry cleaner, a 2nd Chance Community Loan franchise…

Carlos just received “The Letter.” 2nd Chance community Loans is pulling out of California…

The Costs for Producing a 36% APR Loan

So what you say, dear reader? A $2500 loan at 36% interest is ridiculous anyway! “Good riddance to these loan sharks!”

OPPORTUNITY

My Team has invested hundreds of man-hours researching, talking and meeting with savants in “the business of lending money to the masses.” It’s been a whirlwind of action and creativity. The results? Success.

We have solutions [ancillary products, tribal collaborations, automation and fraud reduction strategies, lower CAC and FTPD metrics… for you that offer safe and profitable solutions for you to continue to serve your California communities with emergency funds! Reach out to TrihouseConsulting@gmail.com ASAP for details. We’ve invested the past 6 months evaluating and preparing for January 1st and AB539! We have assembled a Team…

Email Jer at TrihouseConsulting@gmail.com! Include details! Are you a CFL? What type[s] of loan products do you offer? Are you a storefront or internet Lender? Ballpark, how many loans/month? Average term? Avg. loan principal. Installment? Balloon? Additional “color” will move you to the front of the line… We’ll send you an MNDA and share the solutions available for your specific situation!

[Again: want to explore the tribe sovereign nation model? Click Here: https://LeaningRockFinance.com DISCREET is the word.]

PS: If you plan to simply “throw in the towel, to give up… let us know! We are buyers! We are happy to take your California Market share and SCALE big time. The regulators and paid-off politicians can make the business of lending to the masses more difficult BUT they cannot regulate DEMAND away. Demand for loans by credit-challenged consumers is going nowhere but UP! We want your data, your portfolios, your IP, your websites..!

You too can “play” like the big boys! It just takes creativity, iteration, knowledge, and a little help!

Collateralized [Title] Lenders: Don’t abandon California consumers and your employees in need of your help! If you’re a title loan lender, you can remain in business by submitting to this crazy 36% APR while offering “Lender Collateral Protection” to your customers in dire need of your help while still earning a very respectable ROI. And, since the majority of your competitors are not reading this, YOU CAN EASILY SCALE and TAKE MARKET SHARE! A 25-year-old, Triple A-rated insurance company executive Team has a complete turn-key solution ready for you to implement in <30 days! Your out of pocket start-up costs to get up and running? MINIMAL!

Non-Collateralized [Personal Loan/Installment] Lenders: I have another proven strategy for you as well.