<36%: Do you want to remain in business? We offer a turnkey program that will enable you to start/continue offering <36% APR title loans while maintaining a 200%+ ROI on your portfolio.

These solutions for continuing to offer <36% APR collateralized loan products “work” in all states!

1 in 3 Californians Struggle!

Nearly 1 in 3 Californians have a subprime credit score or no credit score at all,6 meaning they likely struggle to access credit through a traditional bank or credit union. Here’s the New York Fed Study: Click

We have 2 Solutions to choose for all States:

Offer CPI: “Collateral Protection Insurance” coverage to your title loan/collateralized borrowers.

OR

Collaborate with a federally recognized Native American Indian tribe. LeaningRockFinance.com ] #consultingservices #ab539 #tribelending #smalldollarloans

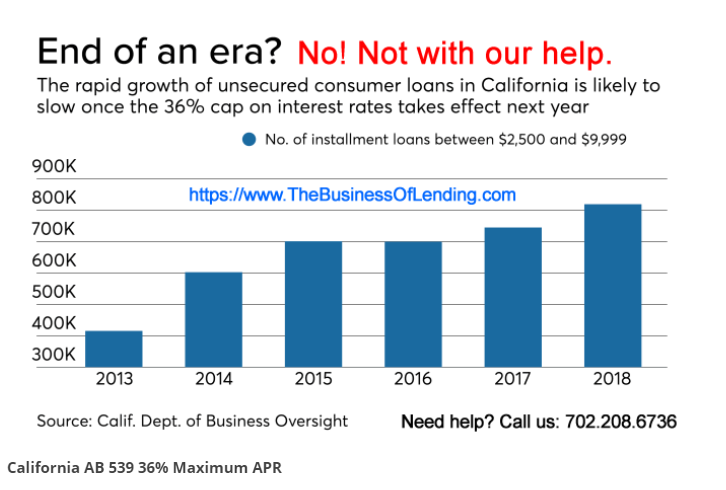

California AB539: The law became effective January, 1st, 2020. California Department of Business Oversight Law: Click Here CDBO

Solutions for <36% APR Lenders

We’ve reviewed hundreds of existing California CFL consumer contracts. The majority already reference the forced-placement of collateral protection insurance to protect the lienholder from a catastrophic loss.

If your contracts do not already have this language, allow our 25-year experienced Team to provide your contract language free of charge.

Additionally, we offer a 100% turnkey package enabling your title loan company – in any State – to offer <36% APR collateralized loan products while still earning superior ROI on your business investment.

Simply email: TrihouseConsulting@gmail.com to schedule an exploration.

Native American Indian Tribe Collaborations

Additionally, if your offering consumer personal loans at ANY APR, we provide collaborations with Native American Indian tribes. This “works” just like the “bank model.” Visit LeaningRockFinance.com for an introduction.